Rare Earth Elements (REEs)

Rare Earth Elements (REEs) are at the heart of the transformative technologies with renewable energy systems, electric vehicles, and cutting-edge technologies.

An expanding market

Facing the highest demand for these applications are the super-magnetic suite of REEs, which includes neodymium, praseodymium (NdPr) and dysprosium (Dy). A key focus of Resouro’s Tiros project, these three REEs are used in:

- Renewable Energy – permanent magnets for electric vehicles, wind turbines and generators.

- Household Items – flat screen TVs, laptops, smartphones and other ‘smart’ battery-powered household appliances, fibre optic cables and self-cleaning ovens.

- Medical Equipment – pacemakers and advanced imaging machinery.

- National security – jet engines, satellites and communication systems.

Exponential growth

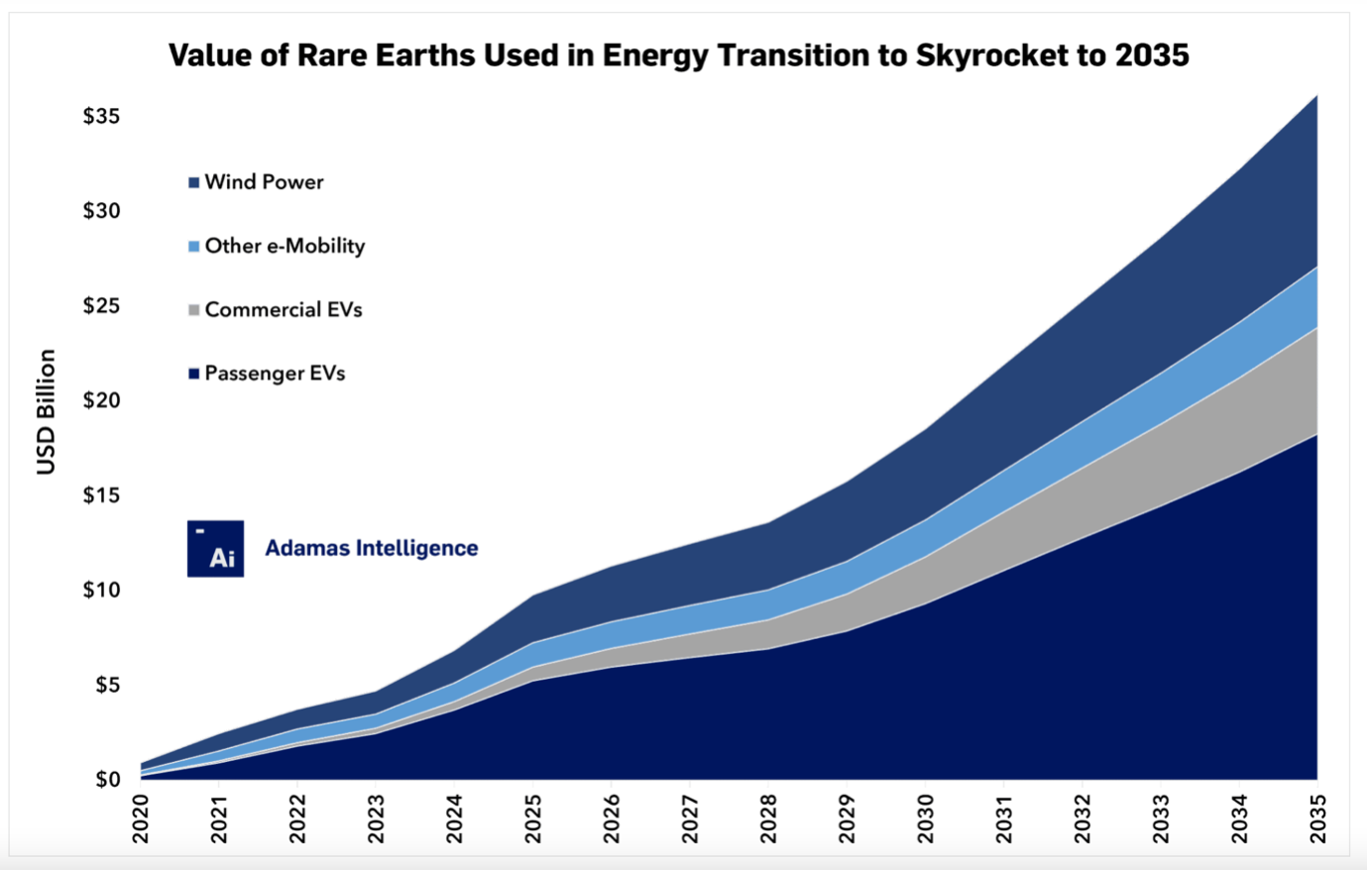

Between 2020 and 2022, the total value of rare earth oxides consumed for energy transition quadrupled. The market value is expected to grow from US$3.8 billion in 2022 to US$36.2 billion in 2035, corresponding to a compounded annual growth rate (CAGR) of almost 19%.

Key Drivers of REE Demand

Between 2020 and 2022, the total value of rare earth oxides consumed for energy transition quadrupled and the market value is expected to grow from US$3.8 billion in 2022 to US$36.2 billion in 2035.

Electric vehicles (EVs)

Wind power generators

Expected to account for 25% of the growth by 2035.

‘EV’ applications

Within EVs is a widening array of micro-motors, sensors and audio speakers that contribute to minimizing vehicle weight, maximizing driving range and reducing battery costs. Like EVs themselves, all these applications use REEs within their batteries.

Global Supply Chain Dynamics

Governments worldwide have intensified efforts to diversify the supply chain for REEs due to their critical role in modern technology.

Currently, China controls about 58% of global rare earth mining and 85% of the midstream and downstream supply chain. However, forecasts suggest that China’s reserves of heavy rare earth elements, which includes dysprosium, may deplete in 11 years at current demand levels. Geopolitical and more generalised considerations about supply chain diversification create opportunities for rare earths miners operating in other parts of the world.

Sources:

Adamas Intelligence, ‘The Skyrocketing Value of Rare Earths Powering the Energy Transition’.

ABC Radio National: Future Tense – Rare Earths and the difficulties of supply.

The Sydney Morning Herald: China’s global grip on rare earths an ‘uncomfortable reality’.